Since the founding of the venture capital (VC) industry, industry leaders have proclaimed that investing in startups is an art, not a science. Yet in almost every finance discipline, from insurance to public equities, quantitative models and indexes have proven broadly effective as a valuable science supplement to human judgment. Quantitative investing (quant) has taken up position atop public market league tables; private markets cannot be forever far behind. Quant has already snuck into the party. It's already on the rise.

What is quant investing?

Quantitative investing proceeds by assembling, cleaning, and pooling vast amounts of data on prices, deals, valuations, etc. Advanced techniques are applied to study patterns of growth, failure, value evolution, and performance. Deep statistical insights can be teased out of data. The best systems learn and adjust their accuracy over time and can be tested on sample data.

Quant venture investing articulates and deploys data science in analytical models to systematically score and predict the success rate of companies, individuals, and financings. These models cover different stages, decisions, and verticals. Some of the pioneers in the public market include Renaissance, DE Shaw, and Two Sigma.

There are issues with the quality and consistency of data and the completeness of the information. Quant in venture and throughout private asset markets looks different as agreements can be bespoke, fluid, and negotiated. There is often more significant uncertainty and risk. There is also less liquidity and readily available data than in public markets, but much of this changing and will continue to evolve.

Quant investing in private markets is already here, just not at scale.

Several funds, including Tribe Capital and Correlation Ventures, have explicitly deployed quant models for years. Tribe Capital describes their structured thinking behind evaluating seed-stage investors going beyond exits and the rate of follow-on capital. Correlation Ventures offers a decision in two weeks and claims to share their data and analysis openly with potential companies. They don't lead rounds, though. SignalFire is another prominent firm with a deep data science component.

Soon most leading firms will employ quantitative evaluations because they need to be competitive.

Quantitative analysis will be incrementally employed across evolutionary stages of the venture value chain - from the earliest stage of founder evaluation to late-stage equity and debt deals. The indicators and outcomes may differ along the way.

There are many advantages of using supplemental quantitative analysis. Here are four:

Scale themselves. Venture Capital and Private Equity firms generally comprise a small group of partners. Sometimes just one or two, rarely over six or seven, and, usually, each partner or portfolio has a defined focus or strategy to maintain an edge. This model is difficult to scale. One human brain can only know so much, see so much, and factor in so many examples or historical periods.

Make fast (and often pre-emptive) decisions. In a world with an abundance of capital and where there is broad consensus on what a great deal looks like, investors who want to win will need to be able to come to decisions quickly. In fact, at later stages, firms who want in on the top deals will need to identify them before they come to market for financing and begin building their relationships. Of course, while this requires human judgment, a fast decision can be made more easily when informed by a robust dataset and a proven framework that can also help raise an investor’s conviction. And that conviction can win deals, which is crucial in private markets where hot deals tend to have multiple options.

Make the best decisions. A quantitative evaluation adds additional information to decision processes. There are two types of decision-making errors: Type I - the models invest when you shouldn't, and Type II - the model says don't invest when you should. Anecdotally, from talking to fund managers, I've heard a lot more of Type II errors - investors over-riding their quant analysis to make an exception for a deal that subsequently turns out to be unsuccessful. Bias and patterns of under- and out-performance are hard to detect. Quant systems can identify and then make recommendations to limit or curb predictable loss drivers and opportunity reducers.

Inform terms and valuation. Quantitative models based on market information can give founders and investors an analytical answer to optimal terms, taking out some of the emotion. At early stages, many funding rounds end up waiting for a lead to set the terms or having a price set by vague notions of a market standard. A quant approach can help set the market price analytically and get to a close faster, particularly when there isn’t a lead.

The inflection point is here driven by increased data and drive for alpha.

Trend Drivers:

More data is available, and storage and manipulation of data have been refined as costs have cratered. Capital is flowing, leading to more liquid markets that are moving faster. This creates more information and better price and pattern discovery. Increased liquidity and deal velocity give models more data points, which in turn can help validate models more quickly. The market has gotten more efficient in surfacing investment opportunities with abundant capital.

Increased demand for alpha in private markets. The pace of technological innovation is accelerating, and companies are staying private longer. Thus, many people believe the most significant returns are in private companies.

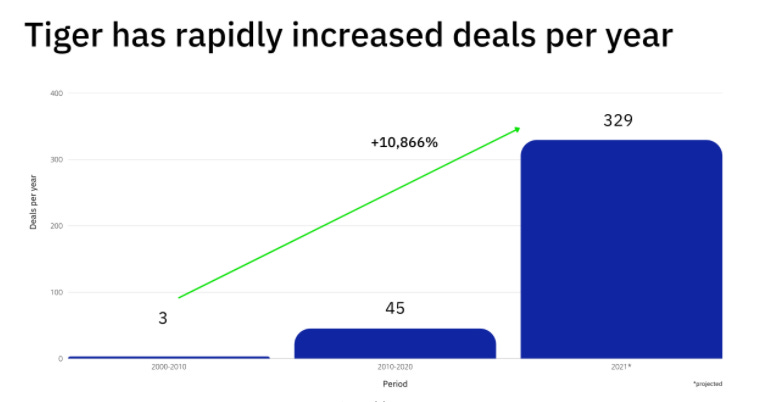

Fund structures are moving toward faster deployment and greater indexing. Venture capital firms are a shrinking portion of venture deals. As hedge funds have entered venture capital and private markets, they have raised bigger funds and are deploying more quickly. Tiger Global and Softbank are prime examples. As described in The Generalist: ‘Kalir echoed this, describing contemporary Tiger as an attempt to "try and own the top decile" of tech companies. In that respect, it looks something like an index strategy or a bet on a particular asset class.’

The downstream implications include an increased emphasis on the human component.

It would be a mistake to believe that quantitative investing models would alleviate the need for thoughtful humans in venture investing. It makes them more important. Why? The best systems, like Systematic Ventures*, build nimble evolving co-bots. These systems are designed to augment and accelerate human skills - bringing science to the art.

Closing and negotiating deals is an art. Venture capital deals still require negotiation on price and terms. Most entrepreneurs want to work with a counterparty that they trust and who adds value. Relationship building and human judgment is critical to getting this right. Placing quantifiable and measurable parameters on a subjective business with a high historical failure rate makes sense.

Playing a trusted steward role in Board governance. The board member's role can deepen and focus on its intended purpose: a fiduciary of the whole company.

Supporting a company through a client-service relationship. Alpha will be generated by those who start from the beginning, help build companies, and unlock game-changing partnerships.

Quant-as-a-service is an emerging category.

Systematic Ventures offers an analytical engine with company, sector, and investor scoring based on machine learning to give investors insight into success and failure rates, and magnitudes. They are powering a venture debt firm.

An experiment from Assure called Signals used data from Specter to identify startups at the stealth stage using machine learning.

Seedscout focuses on scouring the globe for unidentified talent and evaluating it early. They offer pre-seed investors access to their deal flow for an edge pre-accelerator.

AngelList Early Stage Quant is a $25M fund announced in 2021 that uses hiring data to measure the velocity of hiring from the AngelList jobs board platform.

Risks to the trend:

The Limited Partner (LP) market is often slow to react, and incumbent VCs lack incentives to admit the limitations with their current processes. They would be disrupting themselves. However, as quant models and software is eating the world, the mental model of using automation is already happening. VC has proven very resistant to eating its own ‘process and accountability’ cooking. This won’t last as LPs and new entrants to venture increase pressure.

Poor Quant performance. The quantitative models could not generate alpha and miss the most significant opportunities, often unpredictable outliers.

A downturn in private markets. Markets are cyclical, and venture capital has had an incredible run over the last ten years. A slow down in venture investing could happen. Of course, this may drive interest in reducing bias and streamlining processes.

Opportunities for the future

Quants-as-a-service companies that sell SaaS subscriptions to capital allocators of all flavors.

Talent identification. Signals are trying this, and there may be more ways to evaluate technical standards. Talent identification using metrics and data is likely to increase in importance with the rise of evaluating pseudonymous founders, which is more common in the web3/crypto ecosystem.

Dedicated funds who deploy this strategy. There are already a few, but there will likely be many more for the benefits that I described above.

‘Artificial Intelligence at the table’ model where firm investment committees are reconstituted. For example, having two humans and one A.I. decision-maker and all three have to say ‘yes’ to make the investment.

Bottom Line: The use of big data in analytical decisions is here to stay. It's no surprise that the trend is accelerating in venture capital and startups.

Further reading:

Data-Driven VCs: Who Is Using AI To Be A Better (And Smarter) Investor - a more comprehensive list of firms using quant. Published by Forbes Here.

AngelList closed a $25M fund to back startups based on quant models using hiring velocity data.

Quant in Private Markets. Colossus interview Ryan Caldbeck. Here.

Thank you to Max Wolff, Josh Duyan, Eric Scott Lavin, and Miles Lasater for your thoughts, comments, and feedback.

*Disclosure: The author is an investor in Systematic Ventures through Avalanche VC

Great read!