Increased Worker Access to Equity and Ownership

Aligned incentives, increased liquidity, and shared prosperity

Situation:

Consumers and individuals are more aware of assets, stores of value, and ownership. Over the last year, there has been a proliferation of new retail investors and interest in investing, partially brought on by the ease of access to traditional investments on platforms like Robinhood and the rise of cryptocurrencies, which have seen rapid appreciation.

Unsurprisingly, employers and workers have expressed increasing interest in using equity and ownership stakes as an incentive in compensation for employees and for work completed or value added.

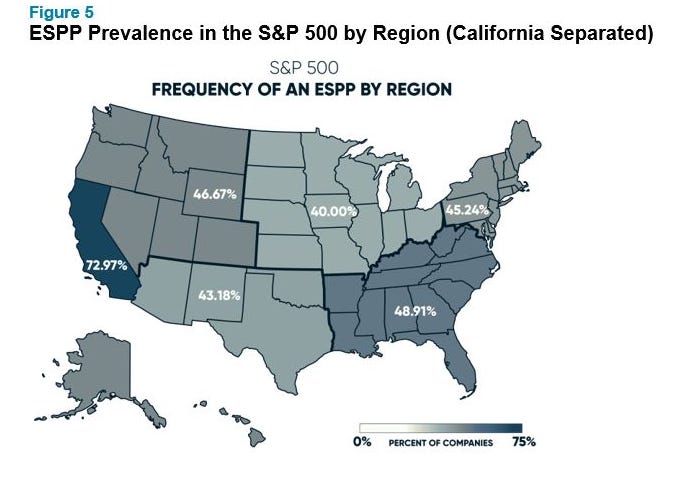

Stock-based compensation isn't new, but it is growing. Aon found 2020 that 49% of S&P 500 companies and 39% of Russell 3000 companies offer an Employee Stock Purchase Plan. It's worth digging into the detail by industry, company size, and geography. As you might suspect, California leads the way.

Several reasons explain the building interest in employee equity:

First, over the last ten years, the share of income going to capital has increased relative to labor. Economists focusing on the corporate sector have found that the labor share of income declined by eight percent from 1980-2012, from 65 to 57 percent. Returns to capital are growing. Wealth is built by owning assets.

Second, high-growth technology companies increasingly rely on stock-based compensation to reward employees. The tech industry has established best practices in modern business and management, particularly in the talent management domain, as talent is the lifeblood of startups. Almost every startup has a dedicated pool for stock options or stock-based compensation, which is a critical tool to attract and retain employees.

Third, investors and managers see shared ownership aligning incentives with outcome-based performance. Both employees who are building a company's infrastructure and essential external stakeholders such as power users, community members, and loyal buyers can be incentivized and rewarded. In the US, brands have found power in crowdfunding investment from their dedicated customers and users. These true believers now own a piece of the company, and their ongoing belief and contributions may be rewarded as the company performs.

Why is now an inflection point?

1) Employees, particularly millennials and those in the technology industry, expect stock as a component of compensation. Millennials have shown an acute awareness and interest in equity compensation, as a result from a survey by Schwab Stock Plan Services shows:

77% of Millennials surveyed said equity compensation was a desirable benefit. An increasing number consider it the main reason or one of the main reasons they took their current job (37%, up from 28% in 2019).

Millennial respondents are the most likely to identify equity compensation as the main reason or one of the main reasons they chose their current employer (53%).

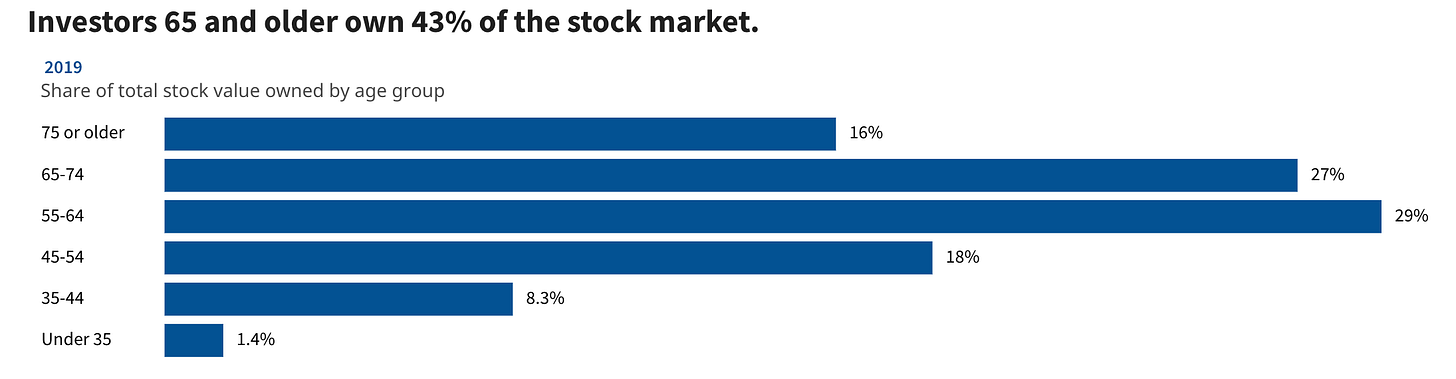

Despite the demand from millennials, they currently own less than 10% of the stock market, as data from Federal Reserve below shows.

2) Increased prominence of private markets. According to McKinsey, private market assets under management grew by ten percent in 2019, and 170 percent in the past decade. The number of active private equity firms has more than doubled and the number of US sponsor-backed companies has increased by 60 percent. As more US employees work for private companies, new equity plan solutions will be devised that gives shared ownership.

3) Starting from a low base. Fewer than one in five US employees own shares in the company where they work, a recent Rutgers School of Management and Labor Relations (SMLR) study found. There is room for improvement.

4) Increased liquidity mechanisms. Over the last ten years, there has been a shift to private markets and a slow but corresponding rise of secondary markets. There is increased liquidity for traditionally difficult-to-trade assets. The rise of cryptocurrencies and tokens expresses the ability of markets to put a value on almost everything and make that value exchangeable. We are still in the early days of secondary markets, but the trend is clear: toward more real-time and accessible trading. For example, Forage is one of the largest secondary pre-IPO private shares markets.

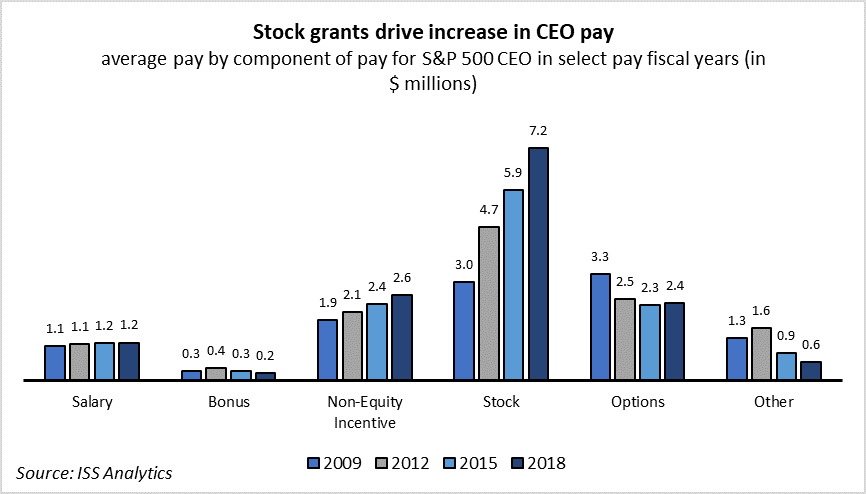

5) Addressing inequality. Top management and CEO compensation have been rising, and a significant portion of the packages are in stock-based compensation, as research from Harvard shows (see below). A 21st Century company will aim to build wealth together with its employees. It is also only a matter of time before ESG-related pressures come for more equitable stock distribution.

There is an opportunity to make stock plans turn-key and simple for recipients to understand.

Simplicity and clarity should increase the value of the equity as it will function as an incentive that employees will not discount relative to cash compensation. Equity administration-as-a-service companies are seeking to capture the opportunity. Carta has been the game in town for companies to manage their cap tables but has a more limited offering on the employee side. Pulley is another startup focused on cap tables and options but less focused on equity plans.

Startups include Upstock*, which makes it easy to adopt an employee stock unit plan and build engaging dashboards to help workers understand the value of their equity; they are seeing strong demand from a wide range of customers, from growth-stage startups to small, local businesses.

Savvy private owners, particularly in private equity, can also benefit by implementing smartly structured plans. For example, KKR uses employee equity to align incentives with frontline workers. Leading this movement for KKR is co-head of North America, Pete Stravos, who recently set up a foundation to promote employee ownership. KKR portfolio company Ingersoll Rand recently awarded $150 million in equity grants to about 16,000 global employees and has seen increased impact on employee morale, employee engagement, employee retention, and company performance (600 -1,200 basis point improvement in EBITDA according to KKR).

New plans are poping up. In August, Teamshares announced $245M of funding to buy small businesses and drive employee ownership.

How could this trend go wrong?

Stock plans can be complex or be presented confusingly. To realize the benefits, those who own assets must understand the terms, conditions, and potential upside.

Stewardship and performance matters. Although the US has been in a bull market for over ten years, not all stocks and ownership stakes increase, and they don’t increase evenly. Navigating through downturns and market corrections is vital. Leadership at the top matters and needs to operate with integrity, transparency, and fiduciary responsibility to benefit shareholders.

The tax and regulatory environment could change to make equity ownership less financially rewarding and more complex.

Bottom line: Broad access to equity and ownership is a long-term mega-trend that will continue accelerating. Investors, managers, and owners will see the benefits of aligning incentives using shared ownership as a tool. Employees appreciate sharing in the upside and ownership of their work.

Further Reading:

National Center for Employee Ownership - Data

Employee Equity Plans - Thoughts from Gusto

Video of Pete Stavros of KKR speaking at their 2018 Investor Day about the impact of employee equity

Information from Carta on how to evaluate different equity plans

Institute for the Study of Employee Ownership and Profit Sharing at Rutgers